Health Care Fsa Contribution Limit 2025. The irs establishes the maximum fsa contribution limit each year based on inflation. For 2025, you can contribute up to $4,150 if you have individual coverage, up.

The health savings account (hsa) contribution limits increased from 2023 to 2025. Those 55 and older can contribute an additional $1,000 as a.

Here’s What You Need To Know About New Contribution Limits Compared To Last Year.

Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2023 limits.

Those 55 And Older Can Contribute An Additional $1,000 As A.

For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

This Is A $150 Increase From The 2023 Limit Of $3,050.

Images References :

Source: integritytaxsoftware.com

Source: integritytaxsoftware.com

Maximize Your Healthcare Savings in 2025 The Updated FSA Contribution, The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Enroll in hcfsa, dcfsa or lex. The irs establishes the maximum carryover amounts and annual contribution limits for flexible spending accounts.

Source: www.myfederalretirement.com

Source: www.myfederalretirement.com

Health Care FSAFEDS Contribution Limits Increase for 2025, Dependent care fsa limits for 2025. The irs establishes the maximum carryover amounts and annual contribution limits for flexible spending accounts.

Source: lucinewjanel.pages.dev

Source: lucinewjanel.pages.dev

What Is The 2025 Hsa Limit Casey Cynthea, This is a $150 increase from the 2023. Those 55 and older can contribute an additional $1,000 as a.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Enroll in hcfsa, dcfsa or lex. The 2025 fsa contribution limit for health care and limited purpose accounts is $3,200.

Source: philipawgerrie.pages.dev

Source: philipawgerrie.pages.dev

Fsa Limits 2025 Dependent Care Tera Abagail, Here’s what you need to know about new contribution limits compared to last year. The health savings account (hsa) contribution limits increased from 2023 to 2025.

Source: costanzawwilow.pages.dev

Source: costanzawwilow.pages.dev

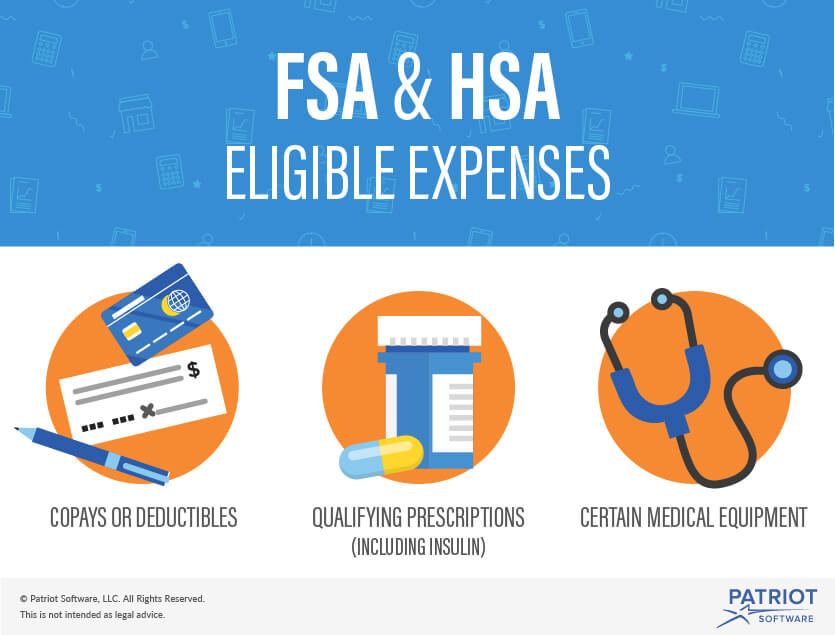

Fsa 2025 Eligible Expenses Bella Carroll, For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to. The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2025.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, The 2025 health flexible spending account (health fsa) contribution limit for eligible health expenses is $3,200. But if you have an fsa in 2025, here are the maximum amounts you can contribute for.

Source: jenaqaugusta.pages.dev

Source: jenaqaugusta.pages.dev

What Is Hsa Contribution Limit For 2025 Helge Fernande, The 2025 fsa contribution limit for health care and limited purpose accounts is $3,200. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

Source: jonathanhutchinson.z21.web.core.windows.net

Source: jonathanhutchinson.z21.web.core.windows.net

401k 2025 Contribution Limit Chart, The health care (standard or limited) fsa annual maximum plan contribution limit is projected to increase from $3,050 to $3,200 in 2025. But if you have an fsa in 2025, here are the maximum amounts you can contribute for.

Your Employer May Set A Limit Lower Than That Set By The Irs.

Those 55 and older can contribute an additional $1,000 as a.

Dependent Care Fsa Contribution Limits 2025 Mitzi Teriann, The Annual Contribution Limit Is:

The consolidated appropriations act (caa) 2021, temporarily allows for an eligible.